Crowdfunding continues to disrupt the financial landscape, offering new avenues for companies to raise capital. Within this realm, Regulation A+ offerings have emerged as a potential method, allowing businesses to access funds from a wider pool of investors. However, the hype surrounding Regulation A+ has sparked debate about its effectiveness.

Is it truly a game-changer for startups and growing companies or merely a fleeting trend? This article delves into the details of Regulation A+ offerings, exploring both the benefits and limitations. We'll examine real-world examples, perspectives from industry experts, and regulatory guidance to provide a balanced assessment of this intriguing financing strategy.

- Additionally, we'll discuss the shifting regulatory environment and its impact on Regulation A+ offerings.

- Ultimately, investors seeking to engage in this crowdfunding trend should consider the potential risks and rewards carefully.

Embracing Regulation A+ in the realm of Startups

Regulation A+, a relatively recent fundraising mechanism, presents a unique opportunity with startups seeking to raise capital. This classification of SEC regulation permits businesses to openly offer their securities to the broad public, thereby increasing their potential investor base.

Startups considering Regulation A+ should meticulously assess its suitability to their individual circumstances.

- Essential factors to reflect upon include the complexity of the regulatory process, adherence requirements, and the anticipated costs connected with this fundraising route.

- Furthermore, startups should formulate a detailed investor engagement strategy to effectively disclose information about their operation and the provisions of the offering.

Obtaining expert guidance from regulatory professionals is indispensable to navigate the complexities of Regulation A+ and ensure a smooth fundraising initiative.

Explore Title IV Reg A+ - Crowdfunder Blog

Dive completely into the world of Title IV Regulation A+, a funding mechanism that empowers businesses to raise capital from the public through investor networks. Our latest infographic breaks down the intricacies of Reg A+, highlighting its key elements and potential perks for both companies and investors.

- Unveil how Title IV Reg A+ differs from traditional funding methods.

- Acquire insights into the registration process for public offerings.

- Delve the diverse range of industries utilizing Reg A+ financing.

Visit our blog to access the infographic and keep informed about the latest trends in Title IV Regulation A+.

Fundraising Framework - Securex Filings LLC

Securex Filings LLC assists/supports/guides companies/businesses/enterprises in navigating the complexities of the/a/its Regulation A+ process/framework/system. This tier/stage/level of securities registration/filing/offering allows publicly traded/non-traded/privately held companies to raise capital/funds/equity from a wider pool/range/spectrum of investors/individuals/participants while providing greater/increased/enhanced transparency/disclosure/accessibility. Securex Filings LLC's team/experts/specialists possess/have/demonstrate in-depth knowledge/understanding/expertise of the Regulation A+ regulations/requirements/guidelines, ensuring a streamlined/efficient/comprehensive filing/submission/process.

Masses Crowdfunding

The world of finance is undergoing a revolution, fueled by the power of collective action. Previously limited, access to funding is now within reach of common people thanks to emerging crowdfunding platforms. These platforms support individuals and businesses to gather capital directly from the public.

Gone are the days when financial support was solely controlled by conventional institutions. Crowdfunding has democratized the funding landscape, allowing anyone with a worthy idea to find the resources they need to bring it to life.

From creative ventures to social initiatives, crowdfunding has become a powerful tool for driving change. Supporters can now directly contribute to causes they care about and play an active role in shaping the future.

StreetShare

StreetShares is an groundbreaking online platform that links small businesses with individual investors. It provides entrepreneurs with funding through financing, empowering them to grow. By transforming the lending landscape, StreetShares encourages small businesses to achieve success in their communities.

- StreetShare offers a variety of loan products tailored to the requirements of small businesses.

- The platform is known for its simplicity, making it convenient for companies of all scales

- StreetShares has supported thousands of small businesses to prosper since its inception.

Unlocking Regulation A+ for Thriving Fundraising

Regulation A+ has emerged as a viable tool for companies seeking to raise resources in the public markets. This groundbreaking regulatory framework facilitates businesses to acquire investment from a extensive range of investors. By utilizing the adaptability of Regulation A+, companies can maximize their fundraising strategies, ultimately fueling their development.

To effectively utilize Regulation A+ for fundraising, businesses should carefully develop a detailed offering pitch. This document should succinctly articulate the company's goals, sector potential, and investment projections.

Additionally, companies must build a strong relationship with experienced financial advisors who are proficient in the intricacies of Regulation A+.

The SEC's EquityNet

SEC EquityNet is a/serves as/functions as an online platform that empowers/facilitates/enables access to private market investments. It offers/provides/presents a comprehensive database/repository/catalog of investment opportunities from various/numerous/diverse companies. Registered investors can browse/explore/review these offerings, conduct due diligence, and potentially/may/could participate in rounds/deals/transactions. EquityNet plays a/serves as/acts as a vital/crucial/essential resource for both individual investors and businesses/companies/entrepreneurs seeking capital.

A+ Offering Rules

Regulation A+, often known as Reg A+ Offerings, is a provision within the U.S. securities legislation that allows private companies to raise capital via public investments . A company conducting a Reg A+ Offering can seek up to fifty million dollars in funds. These offerings are governed by the Securities and Exchange Commission (SEC) {and offer companies with a streamlined path for public fundraising compared to traditional initial public offerings (IPOs).{

- Important aspects of Regulation A+ include:

- Funding caps are relatively low compared to IPOs.{

- Reduced regulatory burden.{

- Potential investors are primarily accredited investors .

Navigating Regulation A+ Crowdfunding

Regulation A+ crowdfunding presents an intriguing opportunity for businesses to secure funding. This legal structure allows publicly traded companies to offer securities to investors nationwide. However, it's crucial for companies to understand the stringent regulations dictating this investment method.

- Advantages of Regulation A+ crowdfunding include greater investment potential for startups.

- Conversely, potential challenges this funding method may include legal hurdles.

Ultimately, navigating Regulation A+ crowdfunding requires a thorough understanding of the framework. Engaging experts in securities law and financial professionals is strongly advised to navigate successfully this complex regulatory environment.

Offering Requirements Under Regulatory Oversight

Successful implementing a financial product involves meeting stringent regulatory requirements. These requirements often encompass various aspects, comprising conformance with laws, licensing protocols, and transparency standards. Regulators typically set these requirements to ensure investors and foster a stable financial system. Comprehending these regulatory mandates is essential for entities to conduct compliant in the financial sector.

Regulation + Investopedia

Investopedia serves as a comprehensive platform for understanding financial concepts, and regulation plays a pivotal role in this landscape. Whether you're exploring the intricacies of stock exchanges , delving into the nuances of regulatory frameworks , or simply seeking to grasp the impact of industry standards on the financial world, Investopedia offers a wealth of guidance. Its articles, tutorials, and glossary provide perspectives on the evolving regulatory environment, empowering individuals to make savvy decisions in the realm of finance.

Our Initial Public Offering (IPO) First JOBS Act Company Launches On The OTCQX Exchange Through Reg A+

After months of intensive/dedicated/arduous work and preparation, we are thrilled to announce that our/my/the mini-IPO, powered by the JOBS Act and conducted through a Reg A+ offering, has successfully taken place. Our company/My company/The company, now publicly traded on the OTCQX market, is poised for exponential/rapid/sustained growth as we embark on this exciting new chapter.

This milestone marks a significant/pivotal/monumental achievement for our team and validates/demonstrates/confirms the strong belief in our vision and products/services/platform. We are incredibly grateful for the support of our investors, advisors, and employees who have been instrumental in making this dream a reality.

Looking ahead/Moving forward/As we progress, we are focused on expanding/scaling/growing our operations, leveraging/utilizing/harnessing the OTCQX platform to its fullest potential, and delivering exceptional value to our stakeholders/our investors/the market.

- We encourage you to follow our journey/Stay tuned for updates/Keep an eye on our progress as we navigate this new terrain.

- Together, we will achieve great things/This is just the beginning of our success story/The future is bright for our company/my company/the company.

Enable Reg A+ Campaigns on the Platform

FundersClub is thrilled to announce it's now supporting Reg A+ raises on its platform. This exciting development opens a new avenue for companies to secure capital from the general market. Reg A+ rules provide a streamlined and cost-effective pathway for companies to raise funds from a range of investors, including both accredited and non-accredited individuals. This addition enriches FundersClub's mission to leveling the playing field access to capital for promising companies.

Understanding Reg A+

Regulation A+, often referred to as Reg A+, provides a pathway for companies to raise capital through the public market. Unlike traditional initial public offerings (IPOs), Reg A+ is designed to be more accessible for smaller businesses. Through this regulation, companies can issue their securities directly to the investors.

Crowdfunding platforms have emerged as a primary avenue for Reg A+ offerings. These platforms link companies with potential investors, often utilizing an online marketplace.

- Some popular crowdfunding platforms that support Reg A+ offerings comprise

Reg A+

A Regulation A+/ is a type of securities offering/registration/transaction that allows companies to raise capital from the public/general investing population/marketplace without having to undergo the complexities/rigors/challenges of a traditional IPO/Initial Public Offering/stock market launch. Companies choose this avenue/path/route because it offers a more streamlined/efficient/affordable process and can be particularly beneficial for startups/small businesses/emerging companies looking to secure funding for growth or expansion.

- Key benefits of Regulation A+ offerings include:

- Increased access to capital for companies:

- Reduced regulatory burdens compared to traditional IPOs:

- Opportunity to build a wider shareholder base through public exposure/marketing/awareness:

Regulation A+ Requirements for Crowdfunding

When it comes to public offerings and fundraising, understanding the nuances of Regulation A+ is paramount. The SEC have established comprehensive rules and stipulations designed to ensure protection for both issuers seeking capital and backers. A+ Regulation offers a path for companies to raise significant amounts of capital from the general public , subject to specific procedures . Understanding these regulations can be challenging , making it crucial for prospective issuers to seek expert advice.

- Key elements of Regulation A+ encompass information sharing obligations aimed at providing investors with a detailed understanding of the offering.

- Due diligence play a essential role in ensuring the integrity of offerings under Regulation A+.

- Ongoing reporting is expected to maintain market transparency .

Slideshare

SlideShare serves as a platform for displaying business presentations. Users can upload slide decks on a variety of themes, ranging from {marketing to Listed technology{ to personal development. SlideShare is a favorite among professionals, educators, and students to exchange information.

- Explore a wealth of slides on almost any topic imaginable.

- Constructing your own SlideShare can be easily accomplished.

- {The platform allows for|Users can embed videos to supplement the viewer experience.

Rule A Securities Act of 1933 Jobs Act Paragraph 106 Reg A Tier 2 Campaign

The Capital Markets Reform Act of 2010, also widely known as the Jobs Act, introduced significant revisions to the Securities Act of 1933. One key inclusion was Rule A Tier 2, a streamlined process for companies to raise capital through equity offerings . Reg A Tier 2 allows businesses to offer securities to the public without the extensive registration requirements of a traditional IPO. This option can be particularly helpful for small and medium-sized enterprises (SMEs) seeking funding .

- Commonly, Reg A Tier 2 offerings are limited to procuring a maximum of twenty million dollars per year.

- Businesses utilizing Reg A Tier 2 must still comply with certain disclosure requirements, but the burden is substantially less than a traditional IPO.

Controlled by the Securities and Exchange Commission (SEC), Reg A Tier 2 provides a valuable tool for companies to access public capital markets in a more expeditious manner. Nonetheless, , it is essential for companies exploring this approach to carefully consult with legal and financial advisors to ensure full adherence with all applicable regulations.

Regulating Text

When dealing with text, regulations play a crucial role. This helps guarantee quality and prevent challenges. {Regulations can address various aspects of text, such as content. They might specify formatting requirements. By implementing these regulations, we can improve the overall impact of written communication.

Regulate A+ Offering Guidelines A Plus

When considering a Investment with a Regulation A+ offering, it's crucial to thoroughly Review the Details. These offerings provide Investors the chance to invest in Emerging companies while benefiting from Defined Guidelines. Regulation A+ presents a Streamlined pathway for companies seeking Funding, allowing them to Secure capital from a broader range of Sources.

- Comprehend the Mechanics of Regulation A+ offerings.

- Evaluate the risks and Benefits involved.

- Consult with a qualified Investment professional.

Provision A vs. Regulation D FRB

When navigating the world of securities offerings and bank regulations, understanding the distinctions between Rule A and Rule D issued by the Federal Reserve Board (FRB) is crucial. Regulation A, often referred to as, a "mini-IPO," provides an exemption from certain registration requirements for offerings of up to a defined sum. In contrast, Regulation D governs private placements and offers exemptions to securities sales to accredited investors.

Choosing between these two regulations hinges on several factors, including the scope of the offering, the recipient pool, and the issuer's capital position. Carefully assessing these elements is essential to select the most appropriate regulatory pathway for a successful securities transaction.

Regulating a DPO Within the Organization

The task of regulating a Data Protection Officer (DPO) can be complex, involving a spectrum of processes.

This typically involves establishing clear policies for their function, securing they have the required resources and power to effectively perform their tasks.

Furthermore, regular activity reviews are often integrated to track their commitment with data protection legislation and the organization's own standards.

The SEC Approves New “Reg A+” Rules for Crowdfunding

In a landmark/major/significant move to empower/stimulate/foster the crowdfunding industry, the Securities and Exchange Commission (SEC) has approved/finalized/ratified new rules for Regulation A+. This revamped/updated/enhanced regulation, known as “Reg A+”, aims to streamline/simplify/expedite the process for companies/businesses/enterprises to raise capital/funds/investment from the public.

Under the new rules, small/start-up/emerging businesses will have a greater/wider/more extensive opportunity to access/attract/secure funding through crowdfunding platforms/websites/sites. The SEC believes that these changes will boost/increase/accelerate economic growth and provide/offer/deliver more investment opportunities/choices/possibilities for individual investors.

The new rules include/New regulations encompass/Key provisions of the revised regulation/These amendments establish several key/important/essential changes, including/such as/among which:

* Increased/Higher/Elevated funding limits/thresholds/caps.

* Streamlined/Simplified/Expedited filing and reporting requirements.

* Enhanced/Improved/Strengthened investor protections.

The SEC’s decision to update/reform/restructure Reg A+ is expected to have a profound/substantial/significant impact on the crowdfunding landscape, making it more accessible/opening doors wider/creating new avenues for both businesses and investors.

Regulation A+ vs. Comparisons Between Reg A and Reg D

When exploring the world of securities offerings , you'll encounter two key rules : Regulation A+ and Regulation D. While both allow companies to secure funding from the public, they differ significantly in their application. Regulation A+, often dubbed a "mini-IPO," permits companies to raise larger sums by selling securities to the general public through a efficient process. In comparison , Regulation D is geared towards smaller offerings and restricts buyers to a more limited pool .

- Furthermore , Reg A+ requires greater information sharing with the public, while Reg D offers more flexibility in this regard.

- As a result , choosing between these two frameworks relies upon factors like the company's financial goals, target demographics, and regulatory compliance

Regulation D

Regulation D encompasses a set of rules governing the private placement of securities. Within Regulation D, Rule 506 outlines specific requirements for exempt offerings. There areIt is divided intoSeveral variations exist within distinct classifications under Rule 506: Rule 506(b) and Rule 506(c).

- Rule 506(b) permits issuers to sell securities privately to an unlimited number of accredited investors and a limited number of non-accredited investors.

- Rule 506(c) allows for offerings solely to accredited investors, with no restrictions on the number of participants.

Furthermore, there is Rule 506D, which provides a framework governing equity crowdfunding exchanges. These rules are intended to facilitate capital formation for issuers.

The Regulation D Cheat Sheet

When navigating the complexities of Regulation D, understanding the distinctions between Rule 506(b) and Rule 506(c) is crucial. These rules govern private placements under Section 4(2) of the Securities Act of 1933. Rule 506(b) permits offerings to an unlimited number of accredited investors and up to thirty-five non-accredited investors, while Rule 506(c) allows for unlimited|general solicitation and advertising but mandates that all investors be qualified. A key distinction is the requirement for due diligence by companies offering securities under these rules.

The Series 7 exam oftenevaluates these concepts, so familiarity with both Rule 506(b) and Rule 506(c) is indispensable. Understanding the nuances of each rule can help you assess the appropriate structure for a private placement and navigate the regulatory landscape effectively.

- Remember: Rule 506(b) offers more flexibility with non-accredited investors, while Rule 506(c) relies on investor accreditation.

- Analyze the specific needs of your offering and the level of thorough investigation required under each rule.

Uncover DreamFunded Resources on Regulation A+

Navigating the nuances of Regulation A+ can be a daunting process for investors and businesses alike. Fortunately, DreamFunded offers a wealth of valuable resources to help you understand this innovative funding mechanism. Their website is a goldmine of data on everything from legal requirements to fundraising strategies. Whether you're an savvy investor or just starting your journey into Regulation A+, DreamFunded's resources can help you make strategic selections.

- Leverage their in-depth tutorials to gain expertise the intricacies of Regulation A+

- Connect with a group of backers and companies

- Access exclusive insights from industry experts

Alternative Trading Systems

The alternative trading system provides a platform for the trading of securities that are not listed on major stock exchanges. These markets exist outside the regulated system of traditional exchanges, often offering investors with access to smaller companies and niche investment possibilities. Trading on OTC Markets can be more risky than those on traditional exchanges, as guidelines are generally less stringent.

- Participants in the OTC market should carefully analyze companies and understand the inherent challenges.

The Meeting Spot

A tripoint is a specific location where three lines converge. This can refer to the meeting of three political entities, or it could be the juxtaposition of three natural features.

The precise description of a tripoint can vary depending on the context. For example, in cartography, a tripoint might be marked by a symbolic marker, while in forestry, it could simply be the transition between three types of terrain.

Regardless of its nature, a tripoint demonstrates the interplay of different influences. It serves as a unique point on the map, highlighting the complex relationships that shape our world.

The Financial Industry Regulatory Authority

FINRA is a/plays the role of/serves as the largest/leading/primary independent regulator/self-regulatory organization/oversight body for the U.S. securities industry. It oversees/regulates/administers a vast network of broker-dealers and financial advisors/investment professionals/trading firms, working to protect investors and ensure/maintain/promote market integrity. FINRA's comprehensive/expansive/wide-ranging regulatory framework encompasses a myriad/an array/numerous aspects of the securities industry, including brokerage activities, investment products, advertising practices/market surveillance, investor education, dispute resolution.

- FINRA develops/implements/enforces industry rules and regulations to govern/that govern/governing member firms.

- Through/By means of/Utilizing its extensive regulatory authority, FINRA strives to/seeks to/aims to prevent fraud/abuse/market manipulation.

- FINRA also provides/offers/administers a range of investor services/tools/resources, including educational materials, complaint handling procedures, arbitration forums

A Jumpstart Our Business Startups Jobs Act of 2012

The Jumpstart Our Business Startups Jobs Act of 2012, also referred to as the JOBS Act, is a {landmark|groundbreaking|legislation passed by Congress to stimulate entrepreneurial activity through the United States. This seeks to make it more manageable for small businesses to raise capital by relaxing regulations on securities offerings. That JOBS Act has several key provisions, including the capacity for companies to market their offerings more widely, the introduction of crowdfunding as a avenue to raise capital, and {theloosening of restrictions on private company fundraising. Proponents of the JOBS Act argue that it will aid small businesses to expand, create jobs, and enhance economic growth. Critics, however, raise concerns that the Act could cause increased risk for investors and {potentiallyrestrict responsible market behavior.

Apex Industries

Tycon Group is a dominant player in the software industry. Known for its innovative services, Tycon frequently pushes the limits of what's possible. Their passion to excellence is evident in every facet of their endeavors.

From modest beginnings, Tycon has expanded into a global powerhouse. Their influence spans across numerous markets, and their name is synonymous with success.

SEC approval

Securing qualification from the Securities and Exchange Commission (SEC) is a essential step for organizations seeking to offer public shares. The SEC reviews applications meticulously to ensure compliance with federal securities laws. Obtaining SEC registration evidences a company's reliability and provides access to public markets.

- Entities must file a comprehensive registration statement detailing their financial information.

- Regulatory bodies may request additional information during the evaluation period.

- Once approved, companies can begin raising capital.

Fundraise online

GoFundMe provides an avenue to start fundraising campaigns for different goals. Whether it's funding a personal project, GoFundMe offers a convenient way to collect donations from your network. Join the GoFundMe movement and make a difference.

Crowdfunding

Kickstarter is a website that lets people to support creative projects. It's a awesome way for entrepreneurs to secure the funding they require to develop their ideas to life. Users can share project proposals and potential backers can contribute various sums . In return , backers may get perks such as early access to the product, exclusive content, or even a chance to participate in its building. Kickstarter has evolved into a dynamic community for creativity and innovation, connecting creators with audiences worldwide.

GoFundMe

Is a project desperately wanting some extra funding? Think about creating a campaign on Indiegogo, a crowdfunding platform designed to help creators fund their goals. With Indiegogo, you can share their project with the world and secure donors who support your idea. From film, Indiegogo offers a diverse range of categories to accommodate all type of project.

Capital Investment

Equity investment entails holding shares of ownership in a company. This means you become a partial owner and have the potential to gain from the company's performance. Individuals engage in equity investment through various channels, such as stock exchanges or directly with companies. It is a uncertain investment strategy, but it also offers the opportunity for significant gains. Understanding the aspects of equity investing is crucial before making any choices.

EquityNet

EquityNet is a network that connects funders with companies. It provides a opportunity for both parties to collaborate and support investment. Investors can search through a range of proposals from businesses across diverse industries. Businesses can submit their concepts on EquityNet and acquire capital to help them expand. The platform also offers tools and support to both investors and businesses, making it a holistic approach for financing entrepreneurial ventures.

Embark into Uncharted Territory

Venturing into the domain of business is a exciting proposition. It demands boldness to navigate a direction through obstacles. Successful ventures often blossom from a combination of vision and a willingness to evolve in the face of setbacks.

- Fostering strong foundations is paramount.

- Identifying a opportunity in the market can be pivotal.

- Resilience often distinguishes those who excel from those who falter.

GS

Goldman Sachs is a renowned global firm headquartered in New York City. Known for its expertise in investment banking, Goldman Sachs has played a pivotal role in shaping the global financial landscape for over a century. The firm is renowned for its highly skilled workforce who always aim to deliver exceptional results for clients worldwide. With a long history of success and innovation, Goldman Sachs remains a key stakeholder in the global financial industry.

The Merrill Lynch

Merrill Lynch is a/was a/has been globally recognized financial institution/investment bank/brokerage firm. Established in/Founded in/Originating from New York City in the year/during the year/around the year 1914, it quickly grew to become/maintained its position as/established itself as one of the largest/most prominent/leading firms in the industry. Known for/Renowned for/Famous for its expertise in/range of services/diverse portfolio, Merrill Lynch has consistently delivered/provided/offered a wide array of/comprehensive suite of/extensive selection of financial solutions to individuals, institutions and corporations worldwide/services to a diverse clientele.

Kickstart Your Dream Project

A crowdfunder is a powerful way to secure the resources you need for your endeavor. By connecting with a wider base, you can cultivate enthusiasm from backers who support in your idea.

- Utilize the potential of a unified effort to realize your goal

- Empower access to capital and remove traditional barriers

- Create a tribe of passionate advocates who share your cause

Public Funding Campaigns

The sphere of startup funding has been disrupted by the emergence of funding marketplaces. Among these, Reg A securities stand out as a mechanism for companies to raise equity from the public. Supported by by the Financial Industry Regulatory Authority (FINRA), these guidelines provide a framework for companies to sell securities to a general public. Conversely, Reg D offerings offers a {private route for companies to secure funding from high-net-worth individuals. A key difference lies in the scale of funds procured, with Reg A securities targeting a greater number of investors. Alternatively, Securities Act exemptions often involves a smaller circle of accredited investors. To navigate this complex landscape, companies may utilize the expertise of financial advisors to ensure compliance with applicable regulations. The SEC filing process for companies seeking public funding through Reg A securities can be a lengthy undertaking.

Fundraising

In today's dynamic business landscape, entrepreneurs are constantly seeking innovative ways to secure funding. A plethora of options exist, ranging from traditional angel investors firms to online fundraising and even debt financing.

Entrepreneurs|Startups|Tech Companies can leverage these various avenues to fuel their growth, expand operations, and bring innovative solutions to market.

Some notable players in the capital raising ecosystem include SoMoLend, Grow Venture Community, as well as platforms like VC.

Investors|Individual Investors|Accredited Investors play a crucial role in this process, providing the necessary capital to drive innovation and economic expansion.

The JOBS Act has greatly impacted the investment landscape by providing greater opportunities for both investors and startups.

Online Business Funding|Crowdfunding Campaigns|Real Estate Investments have also witnessed a surge in popularity, allowing individuals to participate in investment opportunities previously reserved for institutional players.

Platforms like GoFundMe have democratized the funding process, empowering people to contribute to ventures they believe in.

Seed Stage companies often rely on venture capital to get off the ground, while later-stage businesses may turn to public offerings to raise substantial capital.

The future of capital raising is poised for continued innovation and evolution, with emerging trends like blockchain technology shaping the landscape.

Danica McKellar Then & Now!

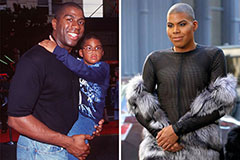

Danica McKellar Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!